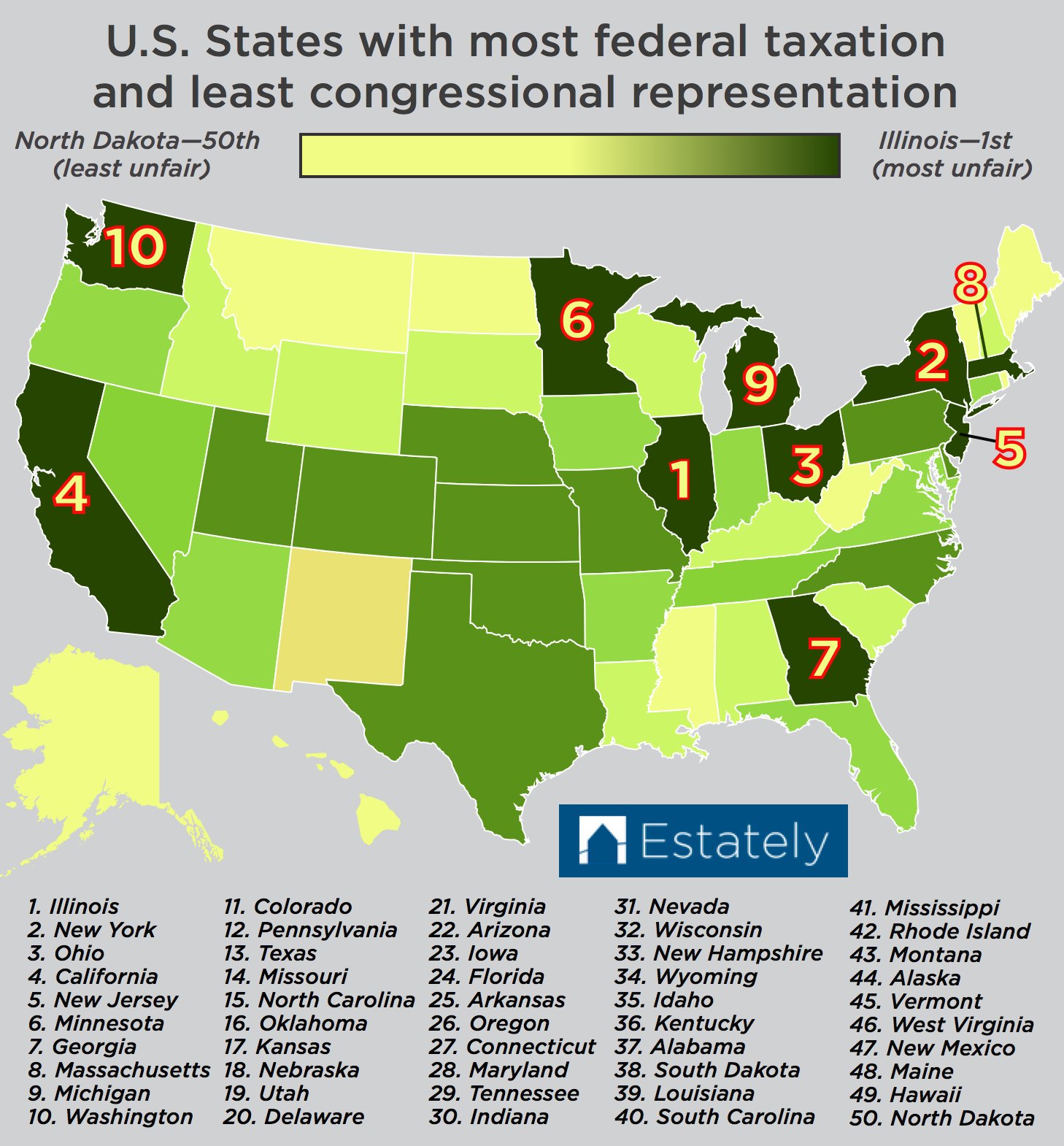

Which States Have the Highest Taxation and Least Representation?

When American colonists declared their independence from Great Britain, one of their largest grievances was, “Taxation without representation is tyranny.”. With the obviously glaring exception of the District of Columbia, which still has no vote in Congress, no U.S. state can make that complaint anymore. However, that doesn’t mean each state is taxed equally, nor represented equally.

When it comes to taxes, some states receive far more federal dollars than they pay in taxes to the federal government. According to a study by personal-finance website Wallet Hub, South Carolina receives $5.38 for every $1.00 it pays to the federal government. Compare that to Delaware, which receives just $0.31 for ever $1.00 it pays.

As the Founding Fathers intended, states with smaller populations have greater representation in Congress than larger states. Even though California has a population over 65 times that of Wyoming both states have two U.S. Senators.

To create our overall rankings we ranked each state from 1-50 based on the number of federal dollars they receive to tax dollars paid to the feds. Then we ranked each state from 1-50 based on population divided by the number of Congressional Representatives and Senators. We then averaged those two rankings to determine our final rankings.

Not surprisingly, states with larger populations tended to gravitate to the top, and smaller states to the bottom. Interestingly, blue states tended to appear higher on this list, meaning red states generally had lower tax burdens and greater congressional representation.

Looking to buy a home in one of these states? Check out Estately.com.

OTHER ARTICLES FROM ESTATELY

U.S. States Most/Least Likely to Survive the Zombie Apocalypse

You Can Learn a lot About America From Each State’s Internet Search History